How To Assess The Competitive Playing Field Of Your Startup: The 3 Main Areas To Research

12th Aug 2020

The feeling you get after discovering an idea that could potentially innovate or revolutionize the sports industry, is amazing.

You immediately sense the possibilities of how your idea can improve people’s lives or impact companies’ efficiency. You might even envision how you create a living out of it, by establishing a company around it.

But before you can turn that vision into an actual business - which means finding people willing to pay you for your solution - you’ll have to start with one question: did you actually find a problem worth solving?

Because the last thing you want to do, is to blindly dive into something, squander all of your (personal) resources and eventually give up on your dream, disillusioned.

What you should do instead, is spending some time to research your ‘problem space’, as business accelerator imec.istart calls it. You do this by 'getting out of the building' and talking to your end user or observing the context in which (s)he operates.

Every entrepreneur needs to start with understanding the current practices of their target audience.

The logical first element to explore in your problem space is: who are your potential customers, and why? (Remember, be sure to not get caught in the one-lead-user trap.)

The second element is equally or maybe even more important: how are those potential customers coping with the problem that you’re trying to solve, today?

You will have to visualize their ‘journey’ and current practices to really understand their frustrations, wants, needs, delights ànd satisfiers, as well as where they’re at in the current state of things. You’ll need to find the different components that drive your end user to make certain decisions. The best question you can ask then is; besides my solution, what’s my potential customer’s alternative to his or her problem?

This in turn will clear the path to another important business aspect: gaining a deeper understanding and better estimation of the competitive landscape you are in as a business.

In most cases, the state of your competitive landscape can be mapped by assessing 3 distinctive current practices.

Here are the 3 main areas you should research to have a clear view on your competition.

1. Direct and indirect competitors

Competitors offer the same or a similar product or service, and can be divided into direct or indirect competitors.

Direct competitors are mostly aimed at the same target market and customer base, with the same way of approaching the business. This means that your direct competitors are targeting the same audience, in a similar distribution or business model as yourself.

Indirect competitors on the other hand are companies that offer the same products and services, much like direct competitors; however, their business approach is different. For example, in your case, the product could be your central asset, while for your competitor it might just be one part of their offering. These competitors are seeking to grow revenue with a different strategy.

2. Alternatives

Alternatives are all the practices and products customers use, that help them achieve the same goal, but that are clearly distinct from your solution. Most of the time, they stem from different industries or domains.

3. Customer behaviour

Customer behaviour is the most underestimated, but possibly the most important element to research. Consumers find themselves in specific situations, and in their quest to reach their goals, might start showing certain behaviour to solve their problem instead of using existing solutions that look like yours. In many cases you’ll see inefficient behaviour, which in turn opens up possibilities for you.

How to apply this to your startup situation

Let’s illustrate this by using an example.

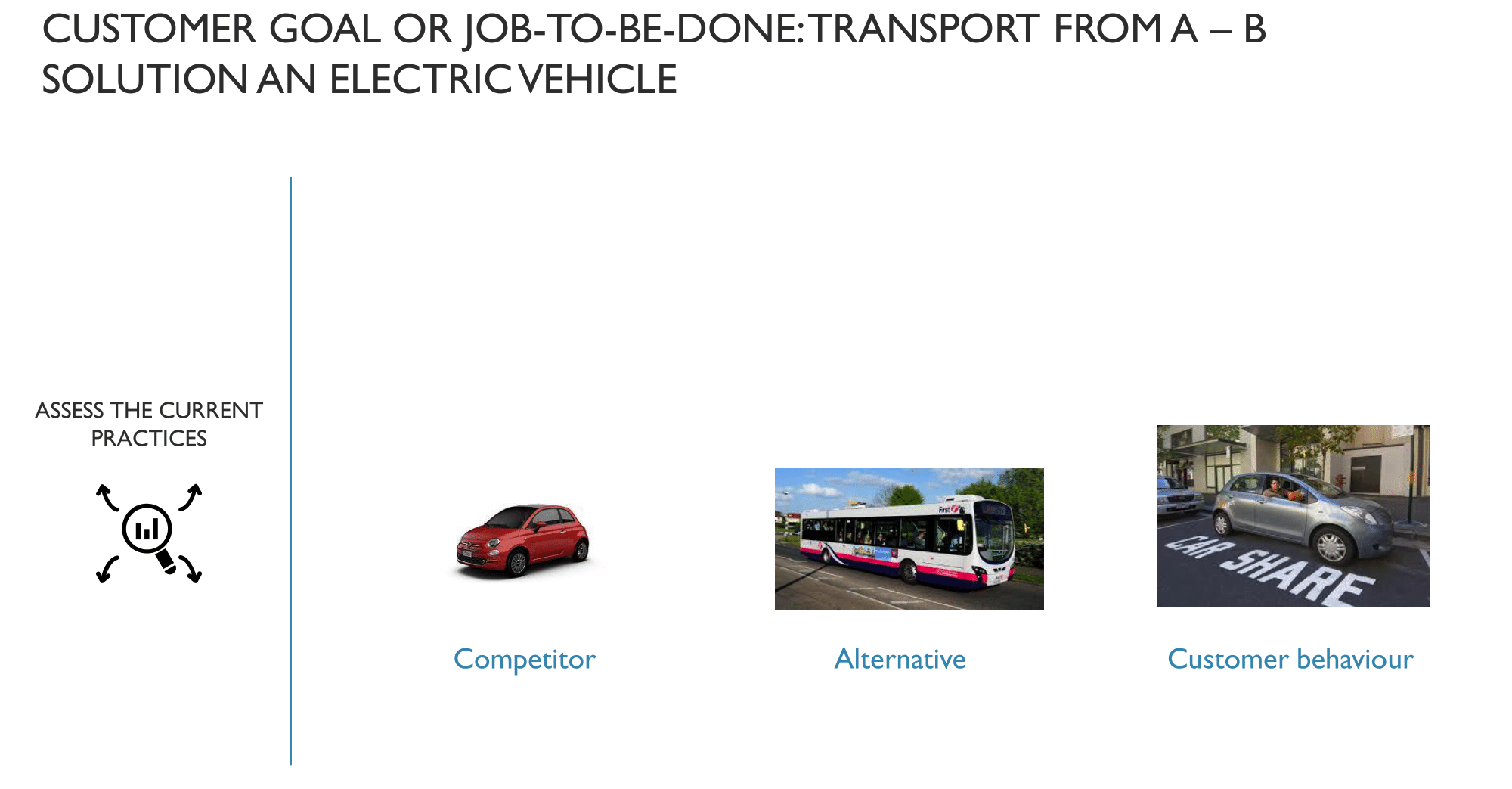

Imagine you’re developing an innovative electric vehicle as a new way of transportation. The main customer goal or job-to-be-done here, is reaching your destination, or simply put: transport from A to B.

Imagine you’re developing an innovative electric vehicle as a new way of transportation. The main customer goal or job-to-be-done here, is reaching your destination, or simply put: transport from A to B.

When placing yourself in the position of your target customer (who has a transportation need), the first thing that could come to mind are your direct competitors: producers and brands of other vehicles. E.g. Renault, Fiat, Mercedes, Volvo, etc. Depending on your solution and offering, this could be segmented less or more specific. These are alternatives in a very literal sense.

But what are other existing alternatives from a broader standpoint? If you challenge transportation that’s based on getting from A to B with a car, alternatives could be the bus, tram or train. If your aim is tackling short transportation distances in the city, alternatives become bikes, steps or electric motorcycles.

Both these two elements depend on how you’re planning to position your product and which segment you want to attack.

The third element, behaviour, is the most interesting. Consumers could very well not show the behaviour at all, thus showing that they’re not willing to buy a car or aren’t able to use existing solutions. Or they do everything by foot or hitchhike.

An other example or shown behaviour here could also be carpooling, which combines behaviour (not owning a vehicle) with an alternative (the person travels a short distance to join someone else’s ride to get to the destination) and a competitor (the carpool-driver owns a non-electric vehicle).

Takeaway: have practical awareness, it will help you make the right business decisions.

Being conscious of your competitive surroundings and the playing field you’re in, is very important as an entrepreneur. Always keep an eye on how your target consumer is acting regarding the problems they’re experiencing and how the market is moving. If you do that, you’ll be able to determine and fine-tune your direction and carve out your success.